Are Property Taxes Rising in King and Snohomish Counties? Here's What You Need to Know.

If you’ve opened your latest property tax bill and felt your eyebrows shoot up, you’re not alone. Homeowners across King and Snohomish Counties are grappling with steep increases, and I’ve been hearing from more and more folks wondering, “What’s going on?”

Today, we’re diving into what’s behind these hikes, how much taxes have gone up over the past decade, what’s coming next, and how you can figure out your own property tax bill (plus a couple of ways you might be able to reduce it).

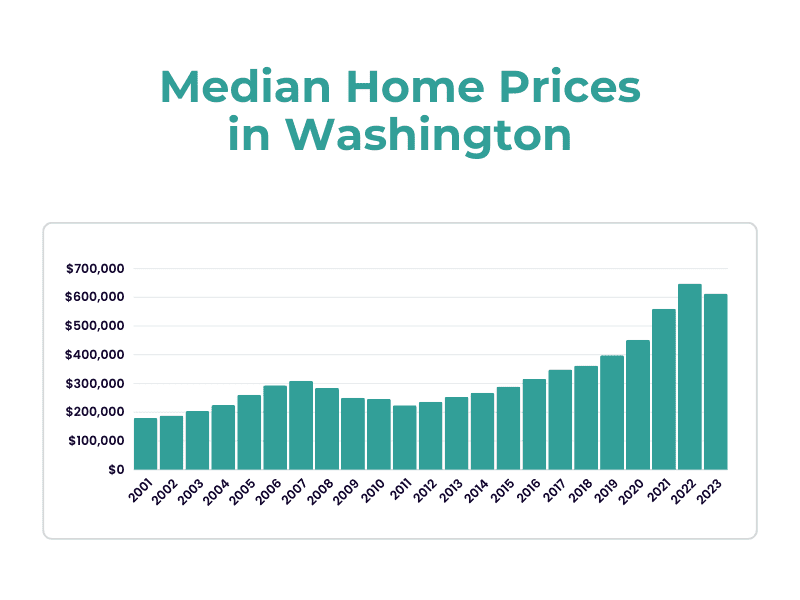

A Decade of Climbing Property Taxes

Let’s start with King County. Over the last 10 years, the average assessed property value has grown by roughly 11% annually, according to the King County Office of Economic and Financial Analysis. In Seattle proper, that number hovers closer to 10% per year. That’s a massive jump, especially for long-time homeowners who aren’t necessarily making more money year to year.

Even with a slight dip in values in 2024 (a rare 5.6% decrease across the county), property tax collections still rose by $121 million, reaching $7.7 billion in 2025.

Over in Snohomish County, the pattern isn’t much different. Property taxes collected in 2025 jumped 5.96% over the prior year, totaling $1.851 billion, according to this official press release. And in 2024? Another 4.64% increase. These aren’t isolated blips, they’re part of a steady upward trend.

Why is This Happening?

The rise in property taxes is largely driven by two things:

1. Skyrocketing Home Values

Even if you haven’t done a single renovation, your home’s value might have doubled in the past decade. And the higher your assessed value, the more you owe, regardless of your income or whether you plan to sell.

King County’s 2024 update shows that many areas, especially on the Eastside, saw assessed values increase by up to 20% in just one year. In Snohomish County, it’s a similar story, values continue to rise in most areas, which pushes tax bills up even if levy rates stay the same.

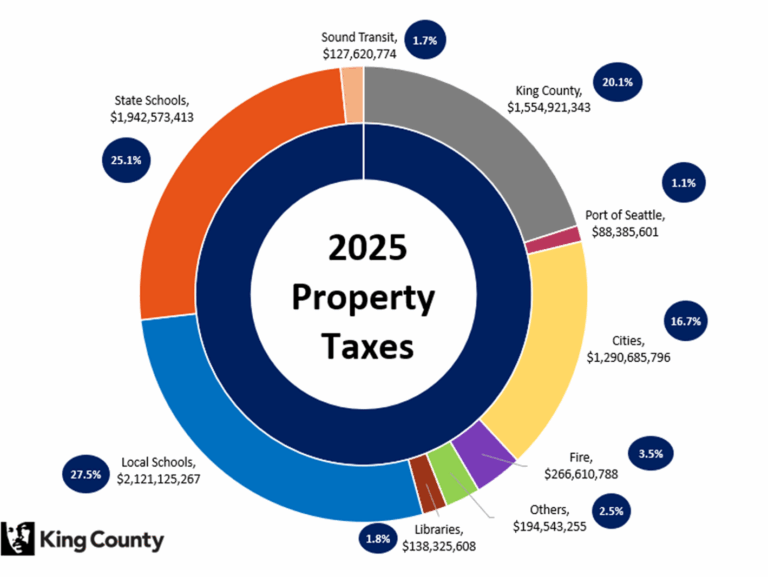

2. New and Expanding Levies

Property taxes aren’t just one flat rate, they’re a combination of rates from your city, county, school district, fire district, and more. When voters approve new levies or bonds (say, for public schools or parks), those costs get tacked onto your tax bill.

And even when they don’t, some governments are quietly raising rates. Snohomish County recently approved a 4% increase for the next two years, opting for a “compromise” after initially proposing an 8% hike.

What’s Coming Next?

Washington State has a 1% cap on how much property tax revenue can grow each year, but legislators have been trying to change that.

This year, there was a proposal to raise the cap to 3%, which would’ve generated $236 million more for local governments. It didn’t pass, but as reported by the Washington State Standard, it’s clear the pressure to increase revenue isn’t going away anytime soon.

Axios reported that similar proposals could return next session, with lawmakers projecting up to $818 million in new revenue over four years if the cap is lifted.

So while this year’s effort failed, it’s likely not the last time we’ll see this debate.

How to Estimate Your Property Tax?

If you’re curious how your own property tax bill is calculated, here’s the simple formula:

Assessed Value × Levy Rate (per $1,000) = Annual Property Tax

Let’s break that down with a real-world example.

Example: A Home Assessed at $600,000

|

County |

Avg. Levy Rate (2025) |

Calculation |

Estimated Tax |

|

King |

$9.50 per $1,000 |

600 × $9.50 |

$5,700 |

|

Snohomish |

$10.00 per $1,000 |

600 × $10.00 |

$6,000 |

That’s just an estimate, actual rates can vary significantly depending on your neighborhood, city, school district, and voter-approved measures. Want to look up your own? Here are the tools:

What to Do If Property Taxes Are Too Much

If your property taxes are starting to feel like a second mortgage, you’re not alone. I’ve spoken with so many families in King and Snohomish Counties who love their home, but are starting to feel priced out, not by the market, but by the taxes.

For some, especially long-time homeowners, the rising cost just isn’t sustainable.

Here are a few realistic options if your property taxes are becoming unmanageable:

Option 1: Consider Selling – Off-Market or Traditional

If you’ve been thinking, “Maybe it’s time to sell my house,” this could be your moment to explore that path — on your own terms.

- Selling off-market to a local buyer like us means no repairs, no showings, and no commissions. Just a straightforward, respectful sale, and we can move on your timeline.

- If you want to go on the market, we can help connect you with the right agent or simply advise you on what to expect.

You don’t have to rush the decision. But if the property tax burden is too high, selling your home for cash might offer both financial relief and peace of mind.

Option 2: Apply for Tax Exemptions or Deferrals

Both King and Snohomish Counties offer property tax exemptions for:

- Seniors over a certain age

- Homeowners with disabilities

- Limited-income households

There are also deferral programs available that let you postpone part of your tax bill until the home is sold or transferred. This can help reduce your property tax payments now without having to sell.

Option 3: Appeal Your Assessed Value

If you feel your home was over-assessed, you have the right to appeal. This could lower your property tax bill for the year and save you hundreds, sometimes thousands.

Deadlines and instructions vary by county:

Option 4: Stay, But With Support

Your home is more than just a number on a tax roll, it’s memories, milestones, and meaning. If you’re not ready to sell but need guidance, let’s talk. Even if a move isn’t right for you now, just understanding your financial options can be a huge relief.

Final Thoughts

It’s easy to feel frustrated by rising property taxes, especially if your income hasn’t kept pace with your home’s value. And as someone who talks with homeowners daily, I can tell you — this is becoming one of the most common pain points I hear.

I always encourage folks to get informed, check if you qualify for relief, and if you’re feeling boxed in by property taxes, remember: you do have options. Whether that’s appealing, applying for an exemption, or simply learning more, knowledge is power.

If you ever want to chat about your own situation, whether it’s a potential sale, downsizing, or just questions, you know where to find me.